Section 2: Health Benefit Plans – Excerpts Part 2

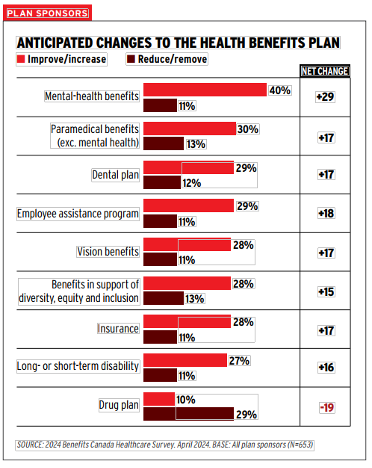

This month we continue to explore this survey of more than 39,000 Canadian members of group health benefits plans. The survey noted plan sponsors were most likely to consider making cuts to their drug plans and improvements to their mental health plans. However, the drug plan is the most-used benefit, followed by massage therapy, physiotherapy and chiropractic services. Let’s dig into mental health, what employees want, and communications best practices.

Mental Health

- The drug plan is the most-used benefit by plan members, and those with a mental-health condition were much more likely to be heavy users of the drug plan (44%) than of mental-health counselling (14%).

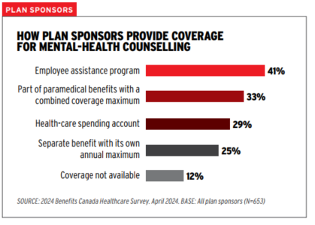

- Forty-one per cent of plan sponsors indicated they cover mental-health counselling through their employee assistance program, 33% under the paramedical benefits umbrella with a combined annual maximum for all services, 29% through the health-care spending account, and 25% as a separate benefit with its own coverage maximum. One in 10 (12%) indicated coverage isn’t available.

- Among plan sponsors that cover mental-health counselling separately, the average annual maximum is $1,743. This breaks down into a third (31%) with an annual maximum of between $500 and $999, a third (31%) with a maximum of between $1,000 and $4,999, and a quarter (25%) providing up to $499 in coverage.

- One in 10 (11%) plan sponsors offer more than $5,000 in coverage for mental-health counselling per year, including 4% with a maximum of $10,000 or more.

What Employees Want

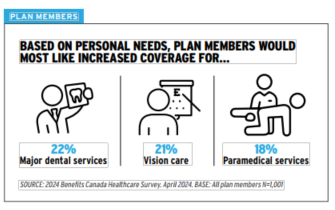

- When asked to choose one benefit for which they’d want improved coverage based on personal needs, plan members were most likely to single out major dental services (22%), such as orthodontics and root canals, a wish that has remained consistent since 2017.

- Plan members were also interested in extra coverage for vision care (21%) and paramedical services (18%). They were least likely to want more coverage for prescription drugs (9%) and mental-health counselling (8%).

- When then asked for which benefit they’d be willing to receive reduced coverage as a trade-off for higher coverage of their preferred benefit, plan members were most willing to cut back on mental-health counselling (30%) and paramedical services (24%).

Communications

- For the second year in a row, fewer plan members said they understand their benefits plan very well.

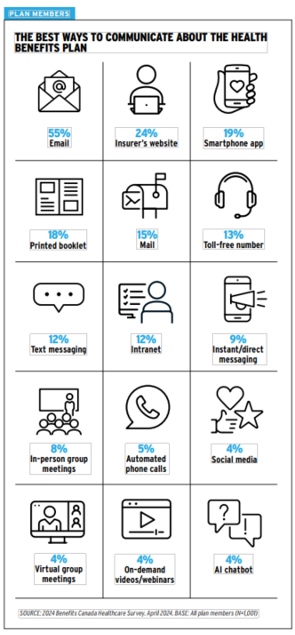

- This finding indicates a need for better member education and tools that help them navigate their benefits plan, such as a one-stop-shop portal to connect them with the resources they need at the moment they need them.

- Advisory board members weren’t surprised to see email come out on top, but noted that email is a passive form of communication and can often get lost or overlooked by plan members, who typically don’t look for information until they need it.

- The board stressed the value and success of more engaging and proactive forms of communication, such as webinars and in-person education sessions.

|  |

|  |