To help keep you informed on topics affecting you and your team, WP & LBS have prepared a summary of trends from 2023 and updates for 2024. As we look back to look ahead, here are some insights to keep in mind:

Looking Back – A Retrospective of 2023

Attracting and retaining employees remains a top priority for employers

This is one of the top reasons plan sponsors offer employee benefit plans and was one of the motivations behind plan costings and changes last year, particularly around mental health. Many employers were also financially constrained in their ability to make plan improvements because of increased premiums resulting from inflationary factors.

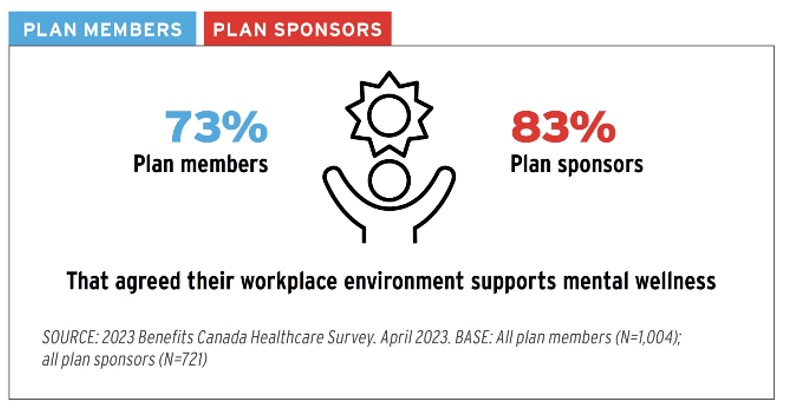

Mental health and wellbeing initiatives still have a way to go

While many employers have boosted their wellness offerings through EFAPs and enhancing mental health coverage, there is a disconnect between employer and employee perceptions and more communication is likely needed.

Mental health & disability claims

Disability claims for mental health continued to increase in 2023 as people continue to grapple with the after-effects of the pandemic. That, combined with decreases in mental health stigma, has led to more people making disability claims for mental health.

Overall, from the WP + LBS perspective, there’s been a steady increase in requests for greater mental health benefits. We’re also seeing employers requesting quotes to separate mental health services from other paramedical services – the latter being more stand alone and generally higher in benefit.

High-cost drugs

High-cost drugs will continue to be a large factor in health plan increases. Specialty drugs (usually defined as those costing over $10,000) often account for almost 30% of drug spend and represent less than 1% of claimants.

Healthcare and wellness accounts

Akin to providing employees with ‘flex’ benefits, there’s been more discussion than ever about healthcare and wellness accounts. The former is more restrictive but not taxable in employees’ hands, while the latter is more exhaustive in scope, yet taxable in employees’ hands (those with taxable income, specifically). Most insurers can administer either – an option with the Life Plan administered by Manulife.

Source: Benefits by Design – A look back at 2023 – Accuracy of our trends and predictions | January 16, 2024

Looking Ahead – A Prospective of 2024

Canada Pension Plan (CPP) Changes

For First Nations and Indigenous employers specifically, CPP is a mandated statutory benefit for non-Status employees. That said, some employers have adopted CPP en-masse for all employees. For employers with private pension plans and CPP-coordinated contribution formulas, the 2024 changes create additional havoc.

A broader pension revamp began in 2019 as both the Quebec Pension Plan (QPP) and CPP began phasing in enhanced benefits intended to provide more financial support for Canadians after they retire. So far, individual contributions – and the employer's matching portion – have primarily ticked upward.

The trade-off is that Canadians will eventually receive higher payouts once they start collecting their pensions. But as of 2024, the CPP includes a new, second earnings ceiling. For those who make more than a given amount, additional payroll deductions now apply.

What you need to know – 2024 CPP Changes

Introducing a two-tiered contribution system for CPP contributions:

- First Earnings Ceiling (YMPE): For 2024, the YMPE is set at $68,500. This is the maximum amount of income subject to standard CPP contribution rate which remains at 5.95% for employees and employers on earnings up to the YMPE ($68,500).

- Second Earnings Ceiling (YAMPE): A new addition, the YAMPE, will be introduced as the upper limit for the second tier of CPP contributions. In 2024, the YAMPE set at $73,200. This new additional contribution rate of 4% for both employees and employers which will apply to earnings between the YMPE ($68,500) and YAMPE ($73,200).

Source: Canadian Press, January 2024

Group Benefits

Incidences of chronic diseases are on the rise as the workforce ages, resulting in increased claims and secondary illnesses. At the same time, increased wait times and decreased access to care only make the situation worse, impacting treatment, and the claims experience of group benefits plans.

Finances will continue to be a major driver of employee stress, as well as employer decisions about their benefits plans. From inflation, high interest rates, the housing crisis, and more, employees are relying more on their benefits plans. At the same time, employers are wrestling with contrasting priorities of providing an attractive benefits plan while keeping costs contained.

Communicating benefits has become a big topic of late – especially given the lack of understanding employees are “communicating.” Look to see more innovative, personalized benefits communication, like reminders via push notifications that are tailored to the individual plan member.

As AI is becoming a bigger part of our daily lives, it’s no surprise that the group insurance industry is looking for ways it can be incorporated. Promising areas for use of AI include risk assessment and fraud detection. However, the progress on the client facing side may be slowed due to privacy and accuracy concerns.

Source: Benefits by Design – A deep dive into health insurance trends and predictions for 2024 | November 28, 2023

Life Benefit Solutions and WP Pensions + Benefits Initiatives

In 2024, employers can continue to expect our team to come to see you and support your plans with tasks such as plan maintenance, governance, and administration. We look forward to seeing and working with you to ensure you and your plan members are receiving the very best service for both pension and group benefit plans.

Members will be given many opportunities to keep learning about their plans. We will continue to offer:

- In person visits to deliver on various initiatives

- Learning resources (materials, webinars, 1:1 pension consultation, staff information sessions, newsletters)

- Timely communications

- Individual Financial Planning Services

- Access to fantastic events (Conferences and Workshops)

Key Metrics & Statistics to Watch

Canada’s Forceasted GDP Growth | Inflation Rate | Expected Interest Rate Decrease |

|  |  |

0.9% | 2% to 3% | Summer 2024 |

Source: BDC

Artificial Intelligence – The future of pension plan administration?

The Financial Services Industry has entered the Artificial Intelligence (AI) phase of the digital marathon, a journey that started with the advent of the internet and has taken organisations through several stages of digitalisation. The emergence of AI is disrupting the physics of the industry, weakening the bonds that have held together the components of the traditional financial institutions and opening the door to more innovations and new operating models.

Many pension plan administrators are striving to understand the potential impacts and opportunities of AI and machine learning on plan administration. One thing is clear: AI is here to stay and is making a splash in the pension world. Plan administrators are presented with unique challenges and opportunities to utilize AI technologies to enhance plan administration and benefit outcomes.

Key Opportunities AI Could Provide in Pension Administration

- Assistance with the collection and analysis of large volumes of member data and forecasting patterns and trends.

- Improve member education and information with respect to their plan enrolment and understanding of plan terms with the support of an online chat box for efficiency.

- Improve investment strategies and outcomes through employing measures such as the use of algorithmic programs allowing investment managers to track economic indicators and adjust portfolios automatically in response.

- Assistance in the selection and monitoring of portfolio managers.

With the advancement of technology, AI is evolving to be a new tool in the toolbox for plan administrators to increase the effectiveness of their benefit delivery and overall member experience while reducing administration costs. Life Benefit Solutions and WP Pensions + Benefits will continue to monitor opportunities for the use of artificial intelligence to enhance the plan member experience. More to come in 2024!